Land has long stood at the heart of Indian ideas about prosperity. Because supply stays fixed, people say it can only rise in value. Yet what looks like growth sometimes hides quiet decline underneath. Though trusted for decades, this belief faces new economic pressures.

Take a close look here: In 2022, Sonam Kapoor sold her Bandra apartment for ₹32 crore – a property bought back in 2015 for ₹31 crore – with media reports highlighting a ₹1 crore gain. Yet once inflation adjustments are applied, the recalculated purchase value rises to ₹40.40 crore, turning what seemed like profit into an actual long-term capital shortfall of ₹8.40 crore.

Picture a scenario where money loses value quietly over time. That quiet erosion shapes how we must view profits from property in India. Instead of celebrating nominal gains, focusing on what remains after inflation reveals clearer truths. Most conversations ignore this angle, yet it defines long-term success. Looking beyond surface numbers uncovers what few admit: actual growth often hides behind rising prices.

Read Also : https://karnatakaland.in/inflation-calculator-full-guide-how-to-use/

Understanding Real Return and Its Importance in India

When prices rise over time, what matters most is how much your money actually grows. That growth, measured each year beyond inflation’s effect, defines real return. Subtracting rising costs from earnings gives this number. One straightforward calculation reveals it

Real Return Equals Nominal Return Minus Inflation

Despite past Indian inflation typically running from 4–6%, with housing costs sometimes rising faster, recalibrating returns matters. When prices seem to double across a decade, the true gain shrinks once buying strength shifts are factored in.

Even modest gains fail to impress when weighed against hidden expenses. During October through December 2023, home prices across India rose only 4.1 percent compared to the previous year – a figure matching typical interest from basic savings, yet possibly worse once upkeep and fees are considered. What appears stable might actually erode value over time. Behind flat numbers lies a quieter truth about real estate returns.

What often goes unnoticed: rising prices alone don’t mean real gains if everyday costs climb faster. Many overlook how purchasing power shifts matter more than headline numbers. A higher balance might still buy less. Growth must be measured against what things actually cost. Value isn’t just in digits going up – it’s in what those digits can do.

Inflation Adjusted Home Costs India?

Between 2019 and 2025, what seemed like growth was actually loss once numbers were stripped of illusion. Though home prices rose by about 17% on paper during those years, reality shifted underfoot – after factoring in rising costs, value shrank by 9%. What looked like progress turned into retreat when measured another way. Numbers often mislead unless viewed through the right lens.

Numbers Explained

- Nominal appreciation: ~17%

- Cumulative inflation (2019-2025): ~25%

- Currency depreciation (INR vs USD): ~18%

Negative Returns Observed

Why did this happen? Rising local prices grew faster than real estate values, whereas a weaker national currency diminished returns when assets are viewed through an international lens. Holding plots of land – assets that yield nothing until sold – feels especially tough under such pressure.

Regional Variations:

- Mumbai shows a nominal growth of 8.84%, yet adjusts to minus 1.18% when corrected for inflation – based on figures from 2012 that reflect broader patterns over time.

- Delhi saw a nominal rate of 17.01 percent. That figure drops to 6.23 percent when adjusted for inflation, based on figures from 2012. Numbers reflect economic conditions at the time without projections forward

- Pune saw a rise of one-third in name, though just over a fifth after costs, based on figures from 2012 – an example where small-scale trends hold major weight

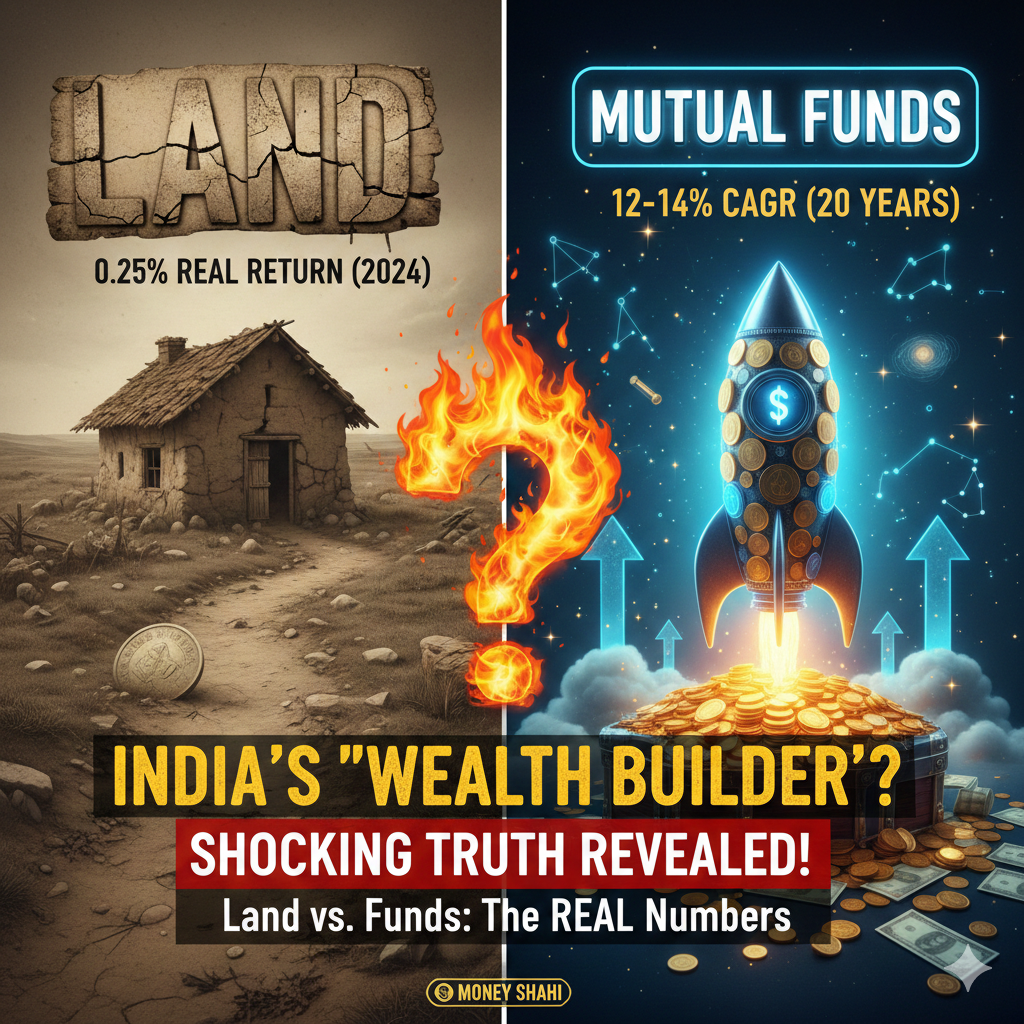

Later numbers back up earlier findings: Global Property Guide shows house prices across India climbed only 3.13% compared to the same quarter last year during late 2025 into early 2025. Once inflation is factored in, actual growth comes out at a mere 0.25%.

Land vs. Residential Property – A Critical Distinction

When people talk about real estate, land often gets mixed up with property – yet their investment paths rarely follow the same pattern.

Land Investment Characteristics:

- Zero carrying yield – No rental income during holding period

- Guessing how much value might rise – every outcome tied to rising prices

- With fewer transactions happening, the number of potential buyers shrinks. Because of this, properties tend to stay on the market longer before selling

- Development upside – Potential for rezoning or infrastructure-driven appreciation

- Limited upkeep expenses – zero repair bills, no community charges, nor handling renters

Residential Property Characteristics:

- Rental yield: 3-5% gross (2-3% net after costs)

- Yearly upkeep includes maintenance, property taxes, plus occasional fixes – typically running 1 to 2 percent of value. Though predictable, these charges add up quietly over time

- Lots of people want to buy it – this makes selling easier compared to empty plots. Movement in the market stays stronger here because interest runs higher. Buyers show up faster, simply put. That pace doesn’t happen out in undeveloped areas. Demand shapes how quickly deals close

- Depreciation: Physical structure depreciates even as land appreciates

A shift in value matters differently for land, since its entire gain relies solely on rising prices. Homes bring some rental flow – even minimal – which may balance inflation while owned. That small buffer leaves land especially exposed when inflation adjusts returns.

According to experts, “Risk is not inherent to land; it arises in unverified or unplanned projects. Structured land with location conviction supports long-term value creation.”

The 20-Year Comparison – Land/Property vs. Mutual Funds

Two decades out, property values pull far ahead of stocks and bonds. Wealth splits sharply along asset lines. Over time, bricks outweigh paper. A long view reveals uneven gains. Real estate climbs while portfolios lag behind. Twenty years magnify the divide. Physical assets gain ground steadily. Financial instruments fall short in comparison. The split widens with each passing year. Distance grows between land and ledger.

Read Also : https://karnatakaland.in/is-your-bank-account-shrinking-the-hidden-inflation-tax-in-india-2026/

The Numbers From ₹1 Lakh Invested Two Decades Back

| Asset Class | Value Today | CAGR |

|---|---|---|

| Residential Property | Around ₹4.4 lakh marks the typical value in housing markets. Eight percent roughly reflects recent growth trends there. That figure appears stable across multiple regions. Growth at this level suggests moderate upward movement over time. Values tend to shift gradually rather than spike suddenly | ~8% |

| Equity Mutual Funds (Nifty) | Equity Mutual Funds tied to Nifty stand at roughly ₹15.2 lakh. Returns hover between 12% and 14%. Performance trends follow market shifts closely. Numbers reflect long-term averages, not guarantees. Past outcomes influence future expectations – yet results vary. Investment value changes with economic conditions. Growth depends on multiple factors beyond index movement | 12-14% |

| Mid-cap Mutual Funds | Middle-sized fund investments stand at roughly twenty-five lakhs rupees or more. Returns hover near fifteen to sixteen percent annually. These figures reflect average performance over recent periods | 15-16% |

Source: Historical market data analysis

Funds that can shift across market caps have returned about 15 to 16 percent each year for a decade now. One such example, Parag Parikh Flexi Cap Fund, has managed returns ranging from 15.77 up to 15.9 percent yearly over the same stretch.

Yet differences emerge when looking closer: property gains shift sharply across small regions. Though some areas stand out, success often depends on precise moments and exact spots. Take Vrindavan – growth near 29% yearly lately – as HoABL chief Samujjwal Ghosh points out. Over forty percent in Ayodhya, another rising cultural hub, during the same stretch. Timing matters just as much as place, even if numbers impress.

Inflation-Adjusted Reality:

- Even with inflation at 6%, mutual fund returns of 12–14% translate into a real gain of 6–8%. That outcome remains favorable despite rising prices

- Real estate returns shrink when inflation hits. With prices rising by 6%, an 8% gain in name only drops to 2% once reality sets in – then fees take more

- A piece of ground that brings in no rent sees its stated return drop from 8 percent to just 2 percent once prices rise. Value must climb exactly as fast as costs do, or gains vanish. Without growth tied to rising prices, the gain disappears entirely. What looks like a modest payoff fades if the land does not keep pace. Returns exist only when price shifts match broader trends

Hidden Costs Eating Into Your Actual Gains

Most individuals examining real estate alongside mutual funds tend to focus solely on initial cost. Yet owning property across India involves notable expenses beyond the listed amount.

Upfront Transaction Costs Land or Property

- Stamp Duty: 5-7% of property value

- Registration Fee: 1 percent

- Construction-related GST sits at five percent, with a reduced rate of one percent applying specifically to low-cost homes

- Legal Fees: Range between twenty thousand and seventy five thousand rupees

- Brokerage: 1-2%

On a ₹1 crore home, stamp duty and registration can cost between ₹6–8 lakh – a sum offering no yield. This outlay needs price growth merely to offset it. Without rising values, buyers start behind. Gains on paper become necessary, not optional.

Ongoing Property Costs

- Society maintenance: ₹3,000-15,000 monthly

- Property insurance: ₹5,000-15,000 annually

- Repairs and maintenance: 1-2% of property value annually

- Property tax: 0.5-2% of annual rental value

- Vacancy periods: Average 2-3 months between tenants

Fewer ongoing charges tie into owning land, mainly just taxes and protection measures; still, it brings in nothing to balance what you spend. Though upkeep runs low, there’s no revenue stream hiding beneath the surface.

Mutual Fund Costs:

- Expense ratios: 0.3-1.5% annually (direct plans)

- No hidden fees, upkeep costs vanish once ownership transfers. Empty periods bring zero financial strain. Taxes at purchase? Absent entirely

Taxation Changes 2025 Shift Property Return Dynamics

A sudden change in property tax rules emerged from the 2025 budget. This adjustment reshapes how investors assess profit potential. Instead of old models, new math now governs outcomes. Numbers once taken for granted require fresh interpretation. Previously stable forecasts face uncertainty. Assumptions underlying past decisions no longer hold. Calculations must adapt to revised structures. Profit margins respond directly to these updated terms. Earlier projections lose accuracy overnight. Financial expectations shift under revised conditions.

| Period | Tax Rate | Indexation Benefit |

|---|---|---|

| Before July 23 2025 | Capital gains held over a long period, when applied to real estate, face a 20% tax rate after accounting for inflation adjustments | Because of indexation, the purchase price accounts for inflation, which lowers taxable profits |

| After July 23 2025 | Property gains held long term face a 12.5 percent tax when indexation is not applied | Despite rising prices, amounts stay fixed without any cost-of-living updates |

Real-World Impact:

| Scenario | Old Rules (with indexation) | New Rules (without indexation) |

|---|---|---|

| Property purchased in 2010 | Back in 2010, one property cost ₹50 lakh. Another also carried the same price tag at that time | ₹50 lakh purchase price |

| Indexed cost (2025) | Approximately ₹85 lakh represents the estimated indexed cost. No data available appears for the second column | Not applicable |

| Sale value (2025) | Two crores rupees mark the 2025 sale value. Worth two million Indian rupees, it stands unchanged across entries. The price remains fixed at ₹2 crore for that year. For both instances, valuation holds steady at this amount | ₹2 crore sale value |

| Taxable gain | A sum of ₹1.15 crore becomes taxable gain, while the amount rises to ₹1.5 crore under different conditions. Though both figures reflect earnings, one stands lower than the other by a noticeable margin | ₹1.5 crore taxable gain |

| Tax payable | Payment due stands at ₹23 lakh compared to ₹18.75 lakh. Difference appears clear when numbers are placed side by side | ₹18.75 lakh tax payable |

In such cases of strong value growth, investors gain under the updated system. When property values rise slowly, the previous rules typically lead to reduced tax burdens.

Whichever method gives a smaller tax will work – that option stays open if the property was bought earlier than July 23, 2025.

Apart from a 12.5% LTCG tax on profits above ₹1.25 lakh each year, mutual funds allow more room to adjust timing of withdrawals. While the rate matches others, choices around when to redeem can shift outcomes.

Liquidity: Often Overlooked Key Factor

Start asking investors about selling land in India when time is short. Usually, it lasts six to twelve months – often more. Locating a buyer can slow things down. Price talks stretch timelines further. Paperwork piles up quickly then. Legal checks take their own course, layering delays on top.

Mutual Fund Liquidity:

| Fund Type | Redemption Time |

|---|---|

| Liquid Funds | Available Next Working Day |

| Debt Funds | Settle in Two Working Days |

| Equity Funds | Settle in three business days |

Source: SEBI mutual fund redemption guidelines

Here is why it counts. When cash is needed fast – say, for health issues, school fees, or starting up work projects – shifting property takes too long. Instead, mutual funds allow quick access; press a button, wait briefly, receive payment soon after. Speed makes the difference when time presses hard.

This benefit of liquidity holds actual worth, yet seldom appears measured in performance returns.

Rental Yield Reality That Land Cannot Provide

A single reason people choose property? Earning rent without daily effort. Yet what the data reveals brings caution instead of excitement.

Gross Rental Yields by City 2025

- Kolkata: 6.32%

- Delhi: 6.19%

- Pune: 5.24%

- Bangalore: 4.86%

- Mumbai: 3.61%

Source: Magicbricks Rental Update 2025

Even though Mumbai has the most expensive real estate, returns from renting are the smallest – rent increases have trailed far behind home value growth.

Practical Reality:

Monthly rental income from a ₹1 crore apartment in Mumbai ranges between ₹30,000 and ₹36,000. Once upkeep costs – typically ₹3,000 to ₹8,000 – are subtracted, along with local levies and unoccupied intervals, returns shrink. Actual profit settles near 2% or 3%. That figure reflects what remains after real-world reductions eat into gross receipts.

A debt mutual fund returns 7–8%, while an NRE fixed deposit offers slightly less at 6–7%. The latter requires no active oversight, unlike some investment options. Returns differ, yet both promise stability without constant monitoring.

Zero returns come from land when it sits idle. That is what happens:

- Every year you hold land, you’re losing the opportunity cost of that capital

- Besides lacking a steady income buffer, you face complete vulnerability to rising prices. Without any financial shield, increases in costs hit directly. Exposure grows when there is no backup stream of earnings. Price hikes take full effect absent protective measures. When expenses climb, the impact lands without delay

- Your future gains rest entirely on growth outpacing both rising prices and ongoing expenses

FEMA and Regulations for Buying Land

For Non-Resident Indians (NRIs), land investment carries additional complexities under the Foreign Exchange Management Act (FEMA).

What NRIs Can Purchase

- Residential properties (unlimited number)

- Commercial properties (offices, shops, warehouses)

- Joint ownership allowed with fellow non-resident Indians or close relatives

Items Restricted for NRI Purchases

- Agricultural land

- Plantation property

- Farmhouses

Source: RBI Master Direction on FEMA, 2023

Hidden among suburban edges, houses labeled “farmhouses” typically stand on plots meant for farming only. Owning one of these homes runs against FEMA regulations, which watch closely over land use near urban zones. Trouble follows when buyers realize they never legally could have bought it – forcing a resale under pressure. These deals unravel fast once authorities step in. A dream home becomes a legal burden overnight.

Repatriation Limits:

- Sold homes abroad may see funds returned – two property limits apply for non-resident Indians. Limits stand firm unless exceptions emerge through regulatory shifts. Property count caps how much money moves across borders. Movement of cash hinges on ownership proof and paperwork precision. Two becomes the maximum when transfers cross international lines

- Each financial year, funds moved back from NRO accounts cannot exceed one million US dollars

- Funds must be transferred through proper banking channels with Form 15CA/CB compliance

Beyond adding layers of complication, such limits introduce timing issues absent in mutual fund setups.

The Opportunity Cost Factor

Money tied up in land might miss bigger gains found in different places.

10-Year Comparison:

Investment outcomes over ten years adjusted for six percent annual inflation

| Parameter | Land/Property | Equity Mutual Funds |

|---|---|---|

| Initial investment | Average land value growth reaches around ₹50 lakh initially. Over time, it moves toward ₹1.08 crore with an 8 percent compound annual rise. The estimated worth after increase settles near ₹60 lakh | Starting with equity mutual funds, the initial amount stands at ₹50 lakh. Over time, it grows to ₹1.55 crore assuming a 12% compound annual growth rate. The profit made reaches approximately ₹87 lakh. Growth happens steadily under these conditions |

| Inflation-adjusted value | ~₹60 lakh | ~₹87 lakh |

| Opportunity cost | Despite the gap, one figure falls ₹47 lakh below. Another trails by ₹27 lakh instead. Each amount marks a distinct shortfall, neither matching the reference point. The variation shows unevenness across values presented | Baseline for comparison |

Had someone picked farmland instead of stocks, the outcome wasn’t merely lower returns – close to ₹50 lakh in possible gains vanished. Not picking shares meant missing out on a major rise. What looked safe turned costly over time. That decision, made long ago, now shows a deep gap in results. Missing the market’s climb led to a heavy shortfall. Gains slipped away, quietly, year after year.

As one commentator noted on the Sonam Kapoor example: “In Equity (Nifty CAGR ~12%): ₹31 Cr → ₹68 Cr. Vs. Real Estate: Just ₹32 Cr. So instead of wealth growing by ₹26 to 37 Cr, it actually got stuck.”

When Land Matters Most: Unusual Market Cases

Even so, some plots of earth have surged far beyond expectation. Success often comes to those who spot triggers early, well ahead of broad recognition.

Recent High-Performance Markets:

- Ayodhya: Over 40 percent growth annually for five years amid temple construction

- Vrindavan: ~29% CAGR (religious tourism infrastructure)

- North Goa: Apart from general trends, high-end plots in North Goa have delivered stronger results. This edge comes from scarce availability, coupled with growing interest in living there. Demand for a certain way of life has lifted values beyond typical levels. Limited space adds pressure on prices, while preferences shift toward coastal settings. Performance stands out when compared to wider market movements

Factors Behind the Returns

- Infrastructure triggers – New airports, highways, or corridors

- Zoning adjustments – new boundaries, targeted economic zones

- Religious/cultural significance – Pilgrimage-driven demand

- Few spots left to build – near water, on slopes, or in historic areas

Waiting takes patience, yet those who succeed often understand hidden markets better than others. Success here demands familiarity with specific regions, a willingness to wait years without access to funds – qualities many simply do not have. Spotting these small-scale chances requires insight most investors never develop. Knowledge of local dynamics becomes essential when returns stay locked far longer than usual.

Portfolio Mix of Physical and Monetary Investments

A mix of property holdings alongside market-based investments often works better than picking just one path. Diversifying across these areas may improve outcomes when accounting for volatility. Some professionals argue that spreading capital this way supports steadier performance over time.

Strategic Allocation Framework:

| Investor Profile | Real Estate | Mutual Funds | Rationale |

|---|---|---|---|

| Near Retirement (55+) | A person close to retirement might lean toward safety. Half their money could sit in stable options, while a fifth goes elsewhere. Comfort comes from owning something real, not just numbers on a screen. Choices often reflect a need for predictability when income shifts. Nearly half may favor low movement, with smaller portions venturing out. Security feels more important than growth at this stage | 20-30% | Stability through physical asset, inflation hedge |

| Mid-Career (35-55) | Middle stage professionals typically see returns between thirty and forty percent. Returns ranging from forty to fifty percent are possible during this phase. Inflation-linked growth often supports these outcomes. Performance tends to rise alongside economic stability | 40-50% | Balance of growth and tangible security |

| Early Career (25-35) | A young worker leans into risk. Roughly a fifth to nearly one-third goes toward growth assets. Half to six-tenths shifts into equities. This balance fuels long-term gains through reinvested returns | 50-60% | Higher growth orientation, ability to wait |

Source: Financial planning guidelines based on SEBI registered advisor recommendations

Implementation Strategy:

- A single home stands at the center, offering stability through personal connection. This asset may serve living needs later, shaping long-term decisions quietly. Its presence supports choices without demanding attention. Value grows slowly, tied closely to daily life. Ownership here means more than numbers – it reflects a quiet anchor amid change

- Funds often serve satellite roles through access to broad markets. Liquidity comes via daily pricing and easy trading features. Diversification spreads risk across many assets at once. Growth builds gradually when returns reinvest over time. Compounding works quietly but adds meaningful value later

- When a clear trigger emerges – patience required over ten years – it might qualify. Timing matters more than price here. Rare conditions must align. Expect delays without that spark. Decades could pass before change appears

JLL research suggests that “real estate acts as the anchor – slow but steady. Mutual funds deliver growth, and gold offers safety. This mix ensures your wealth grows, while being protected from inflation and volatility.”

The Emotional Pull Behind India’s Lasting Attachment to Land

What shapes how people value land often lies beyond numbers. Feelings tied to place matter deeply. Tradition influences decisions just as much as profit motives do. Some attachments resist calculation entirely. Meaning carried through generations cannot be priced easily. Cultural roots shift what seems like a straightforward transaction.

Psychological Drivers:

- Tangibility: You can see, touch, and visit your investment

- Legacy building: A single plot might outlast its owners. Ownership shifts slowly through family lines. Over time, boundaries stay fixed while people change. What one generation builds, another inherits without effort. Roots deepen even when no one tends them. Value accumulates simply by lasting long enough

- Status symbol: Property ownership signals financial success

- Security blanket: “They’re not making any more land”

- Control illusion: Something tangible seems easier to manage compared to digital forms. A paper document gives a sense of grip that a file on screen lacks. Holding an object creates belief in influence, even when outcomes stay unchanged. The hand shapes perception more than logic admits. Reality shifts subtly when touch enters the picture

The Price of Feeling

- Emotional ease comes at a price, seen in how market participants sacrifice returns. Comfort demands compromise, revealed by choices that favor feeling safe over financial gain

- Lower long-term returns

- Complete illiquidity

- Management headaches

- Concentration risk: A single asset within a specific area creates exposure. While isolated, its performance affects the whole. Should conditions shift there, impact spreads fast. One site, one outcome shapes results entirely

Rethinking Land as an Investment

A closer look at Indian property values, once inflation is taken into account, shows an uncomfortable pattern – over ten years, much of the market failed to keep pace with rising prices. What many assume to be a safe store of wealth turns out, in practice, to have lost ground.

From 2019 to 2025, homes in India lost value once price increases were accounted for, returning -9%. Though housing has grown at roughly 8% annually over two decades, stock-based funds have advanced faster – reaching 12–14%. Despite long horizons, bricks-and-mortar investments lag behind market-linked instruments. Past performance shows a widening gap between real estate and diversified equities. While property remains visible, its financial edge fades over time.

Key Takeaways:

- Most people overlook how inflation quietly erodes value. What looks like growth on paper can actually be decline, particularly true for property that doesn’t bring in rent.

- A single street can outperform entire cities. Though broad trends lag behind, certain zones – like Ayodhya, Vrindavan, or parts of North Goa – have surged far beyond expectations.

- Over time, fees pile up. Right from the start, transaction charges – ranging from seven to ten percent – stack on top of steady outlays, making it tough to reach zero gain.

- Now tax adjustments shift how numbers are figured. Without indexation on fresh property buys, gains after taxes look different. What once held steady now bends under new rules.

- What matters most is how fast money can move. Having cash available in a matter of days, rather than waiting weeks, adds unseen worth. This flexibility counts more than numbers show.

- Not every investment behaves the same way under pressure. Spreading exposure across physical holdings alongside market-based tools tends to smooth outcomes over time.

The Verdict:

- Most people who invest find that mutual funds, stocks, and bonds tend to grow faster than inflation while being easier to access and manage. Still, property holds value differently – offering stability when markets shift unpredictably

- Those who understand regional markets often think further ahead. Long-term thinking shows up most where insight runs deep. People familiar with particular areas tend to stay committed longer. Insight into a place can shape how far someone plans. Commitment grows when experience matches opportunity

- Land suits investors who want both psychological reassurance and physical possessions

- Portfolio diversification works best as a smaller allocation

- Success requires guessing outcomes based on expected events

What if feelings about owning land are set aside? Look instead at actual numbers. Decisions grow clearer when facts replace sentiment. Wealth builds slowly, often without drama. One observer once said that mutual funds promise quick wins, whereas property delivers lasting gains – if the pick was wise, the cost fair, the place promising, and time allowed to work fully. Truth lies in patience more than luck.

Frequently Asked Questions

Q1: What is the real return on land investment in India after inflation?

Looking at numbers from 2019 to 2025, homes brought about a –9% return when inflation is taken into account. Without rent coming in, bare land likely did just as poorly – or even more so – since there’s no income to soften the impact of rising prices.

Q2: How do I calculate inflation-adjusted property returns?

To find real return, apply this equation: divide one plus nominal return by one plus inflation rate, then subtract one. Under prior tax rules, the buying cost gets revised through indexation, relying on Cost Inflation Index data issued by the Income Tax Department.

Q3: Which performs better long-term – land or mutual funds?

Two decades on, mutual fund investments grew at roughly 12–14%, while property climbed around 8%. Back then, putting ₹1 lakh into equities could now show about ₹15.2 lakh – real estate holds closer to ₹4.4 lakh. Though both build wealth slowly, one path clearly outpaced the other across twenty years. Growth rates differ sharply when comparing long-term market returns against bricks-and-mortar assets. Money placed in diversified stocks historically multiplies more than twice as much as housing values do. The gap widens further if taxes and maintenance eat into physical asset gains. Past performance shows equity-based instruments pulling ahead consistently over time spans like these. While location matters for land, broader economic forces lift stock-linked portfolios nationwide. Returns from managed financial products tend to stay above inflation by a wider margin. Holding liquid funds allowed reinvestment during dips, unlike fixed immovable holdings. Long-run data favors flexible capital deployment through regulated investment channels. Realized value today reflects how compounding plays out differently between sectors.

Q4: What are the new tax rules for property sales in 2025?

Following July 23, 2025, any property sale brings a flat 12.5% long-term capital gains tax – indexation relief is off the table. If ownership began earlier than that cutoff, however, taxpayers gain flexibility: either accept 9 out of every 80 rupees in liability using index-linked cost adjustment, or pay just one-eighth outright with no adjustments. Whichever method shrinks the bill becomes the path taken.

Q5: How does inflation affect land investment in India?

Over time, gains in land value have roughly matched rising prices across the economy – yet once fees and transfer expenses are factored in, plenty of buyers end up poorer in real terms. Still, certain small areas boosted by new roads, transit, or utilities have delivered notably stronger results.

Q6: What are the hidden costs of buying land in India?

Starting with initial payments, buyers face stamp duty at 5 to 7 percent. Registration adds another 1 percent on top of that. Legal work requires separate payment, often overlooked early on. Brokerage typically ranges between 1 and 2 percent. Moving forward, annual property taxes apply without exception. Security expenses also recur over time. What many fail to account for? The money lost by not investing elsewhere instead.

Q7: Is it better to invest in land or a residential apartment?

Liquid markets often favor apartments, given wider interest from buyers. Ownership of land avoids recurring expenses, though it generates no cash flow. Returns on plots rely entirely on price growth over time. Rental returns from units typically range between three and five percent yearly. Yet upkeep fees, repairs, and aging infrastructure eat into those gains. Turnover tends faster for flats compared to undeveloped sites.

Q8: What is the average rental yield in Indian cities?

From 3.61% in Mumbai, gross rental returns climb to 6.32% in Kolkata. After accounting for upkeep, taxes, and empty periods, what remains usually lands between 2% and 3%. Yield figures shift noticeably across cities, yet real income narrows once costs enter the picture.

Q9: How long does it take to sell land in India?

Frequently six to twelve months – though occasionally more, influenced by where you are, how clear the role is, and what the market’s doing. In contrast, redeeming a mutual fund usually takes just one to three days.

Q10: Can NRIs buy agricultural land in India?

FEMA rules block non-resident Indians from buying farmland, plantations, or rural homes. Breaking these terms might lead to a compulsory disposal of such assets.

Q11: What are the best locations for land investment in India?

Nowhere is growth more visible than in zones where new transport links spark change – airports rising, roads cutting through terrain, factories clustering along fresh routes, places touched by cultural revival. Think Ayodhya, once quiet, now shifting fast; Vrindavan humming with renewed attention; pockets of North Goa seeing sharper demand. Still, success here depends less on broad trends, more on knowing the ground intimately – the unwritten rules, the hidden players, the rhythms outsiders miss.

Q12: How much should I allocate to real estate in my portfolio?

A third to half suits cautious savers, while those less risk-averse may prefer a third up to nearly two-fifths. Bolder planners often settle between a fifth and a third. The rest typically goes toward liquid holdings – aiming at both access and long-term gains.

Q13: Why was indexation removed from property tax calculations?

Indexation adjusts cost prices for inflation, helping investors pay less tax on long-term gains. This perk got scrapped to simplify rules and reduce loopholes exploited by high-income earners. Its removal aimed at fairness across different income groups. Critics say it hurts patient investors. Supporters argue it makes taxation more straightforward. Now taxpayers face steeper real tax burdens despite a reduced headline rate. Inflation adjustments once softened the impact on long-held assets – those days are gone after the 2025 policy shift. A flat 12.5% applies instead, regardless of how much prices rose during ownership.

Q14: Are there any land investments that have beaten mutual funds?

True, niche markets such as Ayodhya – with growth exceeding 40% annually – and Vrindavan, rising nearly 29%, have beaten many traditional fund investments during certain windows. Still, achieving those gains depends heavily on pinpointing the right moment and exact spot, something beyond the reach of typical buyers.

Q15: What’s the biggest mistake investors make with land?

Simply measuring sale amount against buying cost – ignoring inflation, fees, upkeep expenses, or missed alternatives – creates a misleading picture. That gap between appearance and reality turns losses into apparent gains for some observers.

I am Yallappa Bichagatti and i’m seasoned financial professional with over 13 years of extensive experience in the banking and finance sector. Throughout his career, he has held key positions in Retail Banking, Wealth Management, and Corporate Finance, where he specialized in tax optimization, investment strategies, and large-scale portfolio management. Driven by a mission to bridge the gap between complex financial regulations and the common man, he founded karnatakaland.in to provide simplified, data-driven utility tools