One might wonder how feelings about money shape later life choices. Despite numbers dominating headlines, inner beliefs often steer decisions more than data. Depending on background, views on security shift dramatically. For some, peace means savings stacked; for others, it’s family nearby during old age. Numbers alone fail to capture these layers. Culture quietly molds expectations, even when facts point elsewhere. Regional differences add texture few acknowledge. Urban professionals stress portfolios, while rural elders value land and bonds. These patterns rarely make financial guides. Emotional safety nets matter just as much as bank balances. Yet discussions stay fixed on figures, missing human depth beneath.

Read Also : https://karnatakaland.in/inflation-calculator-full-guide-how-to-use/

A fresh look at inflation numbers might question why facts affect people differently – hesitation grips certain readers while others move quickly. One way to explore this gap involves studying reactions rather than statistics alone. The hesitation some feel could stem from uncertainty, whereas clarity drives immediate steps in different individuals. Responses shift based on personal context, not only data exposure. Perception shapes decisions more than raw figures suggest. This angle moves beyond calculation patterns toward human behavior behind choices. Nuances like confidence levels or past experiences play quiet but vital roles. Understanding divergence in responses adds depth often missing in standard reports.

The Shifting Retirement Target

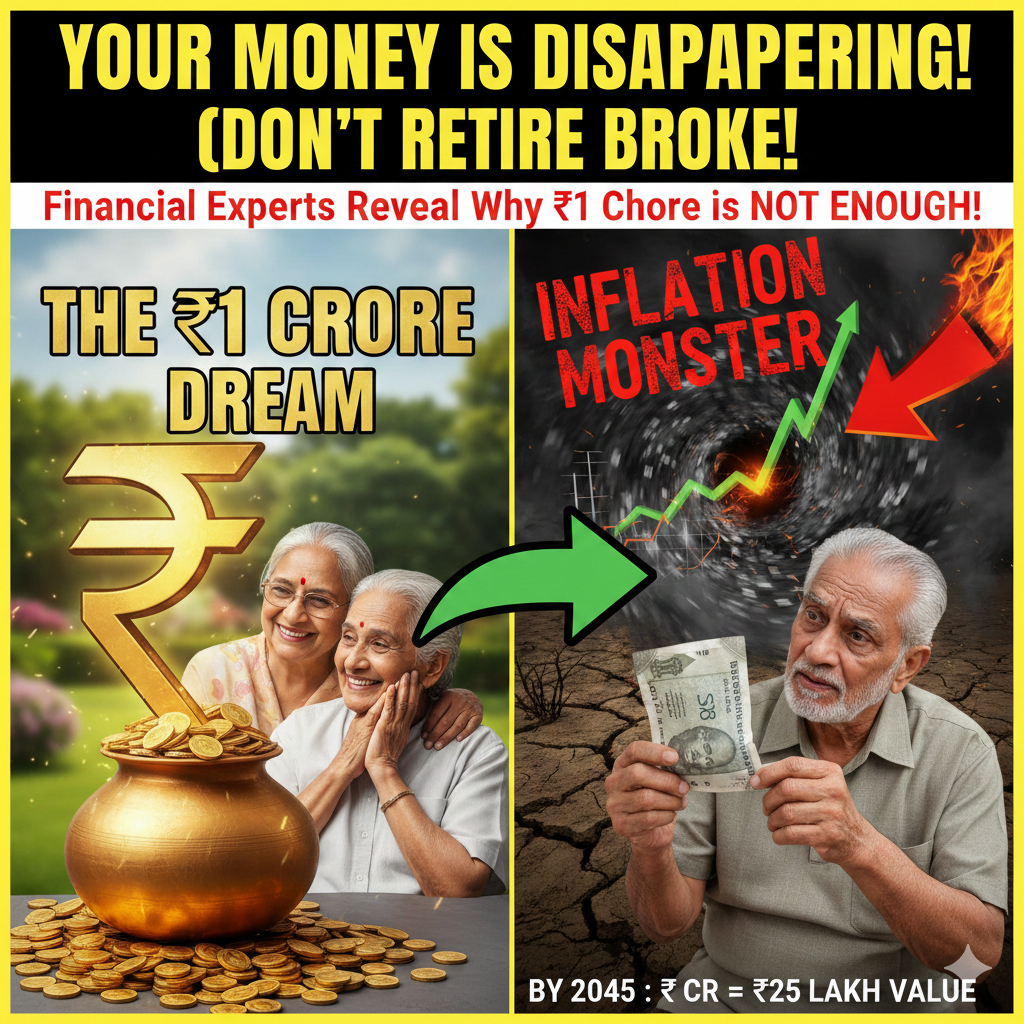

Around India, many picture one big sum when they think of retirement – ₹1 crore stands firm in minds across generations. This amount gained status over years, seen as enough to rest easy after work ends. Yet fresh reviews from money specialists now challenge that belief. By 2045, depending on inflation and lifestyle shifts, this once-solid target may fall short. Falling back on it might even risk stability later in life. What felt safe today could feel thin tomorrow.

Not merely tied to rising prices, this moment reshapes views on money, patience, when work ends – especially across India. Though often seen through numbers, its roots lie deeper – in habits once trusted now questioned under new pressures.

The Quiet Loss of Buying Strength Over Time

Looking back helps make sense of what lies ahead. Imagine holding ₹1 crore in 2004 – how far would it stretch now? With inflation averaging 5% yearly, its true buying power drops to ₹38 lakh by 2024. Flip the timeline. See how today’s money may fade just as fast.

Picture this – money talks, yet its voice changes over time. A sum thought enough today might whisper tomorrow. Experts point out flaws in believing ₹1 crore secures retirement comfort. The number looks solid now, but future value hides a different story. Think decades ahead, say 2045, then imagine buying power worn down by rising prices. Mild inflation cuts worth slowly; sharp spikes slash it fast. Each percentage point adds pressure, reshapes affordability. What buys a home now may cover just walls later. Comfort depends less on lump sums, more on how long savings last. Time erodes currency strength, even if account balances stay unchanged. Confidence in big round figures fades when years pile up. Value does not vanish overnight, rather slips year by year. Planning must shift from target amounts toward lasting resilience.

Inflation Impact Analysis

A rupee today buys far less tomorrow when prices rise steadily. With inflation at six percent, what feels like a large sum now loses most of its strength over time. A corpus of one crore rupees will stretch only as far as thirty-one point sixteen lakh in current terms. Value fades quietly, even if numbers stay the same. Facing seven percent inflation, things worsen sharply. Value of your crore drops to only ₹25.84 lakh. With time, purchasing power erodes fast under such pressure.

Value of Money Over Time With 6% and 7% Inflation

| Timeline | 6% Inflation Impact | 7% Inflation Impact | Monthly Purchasing Power |

| In 10 Years | ₹55.84 Lakhs Saved | ₹50.75 Lakhs Spent | Monthly Feel ₹17,500 |

| In 20 Years | ₹31.16 Lakhs Saved | ₹25.84 Lakhs Spent | Monthly Burden Feels Like ₹16,000 |

Figures come from inflation impact assessments done by analysts registered with SEBI.

Why Aiming for ₹1 Crore Can Mislead

- The Healthcare Time Bomb: Twenty years from now, a medical treatment priced at ₹5 lakh may need nearly ₹19.35 lakh. While broad inflation measures stay stable, healthcare prices in India climb more steeply. Because of this gap, standard economic indicators fail to reflect real pressure on households. Even a well-structured savings pool of ₹1 crore might vanish during a health crisis in later life.

- The Longevity Puzzle: Retirement spans now stretch toward three decades, observes Chennai auditor B. Govinda Raju – longevity reshapes financial demands. Rising life expectancy means savings face pressure far beyond a decade. Instead of short horizons, funds must endure extended periods where costs climb steadily year after year.

- The Magic Number Myth: The biggest trap is the psychological comfort of a round number. “Don’t chase magic numbers,” advises financial writer Sneha Virmani. “Whether it’s ₹1 crore, ₹5 crore, or even ₹10 crore, your number is the one that matches your purchasing power”.

The Real Price of Life in 2045

Picture how far ₹1 crore will really go by thinking about tomorrow’s costs. Suppose retirement begins in 2045, with today’s standard: ₹50,000 each month spent. That comfort demands much more cash down the road. Inflation reshapes value over time, so the amount pulled later must be larger. What seems enough now may fall short when prices rise steadily. By then, monthly needs could double or even triple. So withdrawal amounts must reflect future pricing, not present habits. A sum that looks big today might cover only basics decades ahead. Because money loses ground to rising living costs. Hence, planning means calculating what lies further on. Not just counting current figures.

- At 6% inflation: Monthly expenses would reach one point six lakh rupees.

- At 7% inflation: You will need ₹1.93 lakhs per month.

Your retirement savings need to reach ₹4–5 crores in major cities to maintain steady income, using a 4% annual drawdown. That target climbs because living costs rise sharply in urban areas. So much depends on location when planning long-term withdrawals. One factor shapes another – spending patterns affect how far money stretches. Early estimates often miss these pressures. A fixed rate pulls funds slowly, yet demands larger upfront capital. Metro life simply requires deeper reserves.

Better Choices Today For Tomorrow

A closer look shows how it moves thinking away from loose saving plans toward clear life goals. Instead of aiming at numbers, attention turns to daily living needs. A rupee received today holds far greater value than one decades away – ₹1 crore at present will feel like just ₹25 lakhs after twenty years. Because of this shift, beginning investments early makes a clear difference. Starting sooner allows growth to unfold gradually through repeated cycles of return multiplication. Over time, those cycles open space to reach targets like ₹4–5 crores without strain.

A shift from traditional fixed deposits becomes necessary when inflation runs at 7%, since these savings tools often lose value in real terms. Moving into equity-based mutual funds makes more sense over time, given their track record of outpacing rising prices. Such a move isn’t about chasing risk – it aligns money with growth that matches or exceeds cost-of-living increases.

Advantages and Disadvantages

Pros

- Psychological Comfort: A target like this feels complete somehow – neat in its simplicity, reachable in effort. Though it promises stability, the comfort it brings isn’t always grounded in reality.

- Simplicity: One advantage stands out – this target requires no intricate forecasts. It skips complicated spreadsheets entirely. A clear path emerges when numbers stay straightforward. Often, simplicity wins where detail overwhelms. Precision here does not demand expertise. Anyone can define it quickly. The method avoids layers of analysis. Clarity comes through minimal steps. Fewer inputs mean faster decisions. This approach works without special tools.

Cons

- Erosion of Value: A dollar today buys far less two decades later when prices rise 6-7% each year. Over time, steady inflation quietly shrinks what money can do. After twenty years, only a quarter of its original value remains. Slow but constant, the decline chips away at savings without notice. What seems small yearly adds up into major loss long term.

- Lifestyle Creep: Faced with rising personal standards, retirement plans often overlook how lifestyle desires grow over time. What once seemed luxurious becomes expected. As hobbies demand more funds, earlier calculations fall short. Travel dreams expand, yet budgets stay fixed. Future comfort shifts, but savings strategies rarely follow. Expectations inch upward, even when income does not. Retirement visions evolve quietly, leaving old assumptions behind.

- Medical Cost Gaps: A growing disconnect appears when estimating how fast health expenses increase. Rarely does the projection match reality – costs climb much faster than anticipated. Usually overlooked, the surge defies earlier assumptions. Often ignored until too late, the trend reveals a widening shortfall in planning. Not only do budgets fail to keep up; expectations fall behind as well.

Faq

Q: Is ₹1 crore absolutely useless for retirement in 2045?

A sum like that isn’t zero, yet falls far short when aiming for ease in city life. Though sufficient for bare necessities in rural areas, it lacks room for anything beyond strict essentials. Most envision retirement with more breathing space than constant budgeting allows. Financial planners often point to ₹2.5 crore as a baseline for quieter regions, while metropolitan existence may demand double or even triple that amount.

Q: How much will I actually need if I want to retire with the lifestyle of a current monthly expense of ₹1 lakh?

A sum sufficient to produce ₹1 lakh in current worth is what you’d require. Given a 7% yearly rise in prices, monthly income by 2045 must reach close to ₹4 lakhs. For such an outcome, aiming at ₹7 to 10 crores appears reasonable.

Q: Fixed Deposits may not meet long term financial goals?

Actually, zero gain happens when inflation matches your fixed deposit rate at seven percent. Wealth does not grow under such conditions – it merely survives. Moving forward, gains require stepping into equities for expansion while using bonds to steady the journey. Standing still never builds lasting value over time.

Chase Purchasing Power Instead of Just Crores

At age forty, beginning might feel late – yet timing matters less than starting. One small choice today builds momentum more than perfect planning ever could. Focus shifts when effort replaces waiting. Progress often hides in actions overlooked. The first move shapes what follows, even if unclear at first. Starting creates clarity better than thinking alone.

Imagine your future money needs not as a lump sum, but as steady monthly support. Begin by listing what you spend each month now. Suppose prices rise steadily – around 6 to 7 percent yearly – until you turn sixty. Plug those numbers into a retirement tool to see how much you’ll need overall. After that, raise your SIP contributions annually so they grow close to the amount required.

A harsh truth stands clear – one crore rupees falls short. Thinking otherwise clings to outdated assumptions, when prices rose slower and lives were shorter. Come 2045, the value of that sum will shrink dramatically. What feels like security now will barely stretch far. Action, not despair, defines what comes next. Shifting from fixed targets means building flexible strategies around fair investment choices. Healthcare needs focused preparation alongside money decisions made regularly. Inflation creeps quietly – protect time meant for living well. Begin now, aiming less at large sums and more at lasting comfort

I am Yallappa Bichagatti and i’m seasoned financial professional with over 13 years of extensive experience in the banking and finance sector. Throughout his career, he has held key positions in Retail Banking, Wealth Management, and Corporate Finance, where he specialized in tax optimization, investment strategies, and large-scale portfolio management. Driven by a mission to bridge the gap between complex financial regulations and the common man, he founded karnatakaland.in to provide simplified, data-driven utility tools