This piece offers a clear look at what higher education actually costs in India – especially MBAs and medical programs – and how those expenses line up against future earnings. A closer examination shows numbers matter more than hopes when weighing these paths. Instead of relying on dreams alone, families might find better direction through income trends after graduation. Decisions shift when real-world pay enters the conversation early. Outcomes often differ sharply from expectations set by reputation or status. What follows aims to ground choices in figures, not feelings.

Introduction

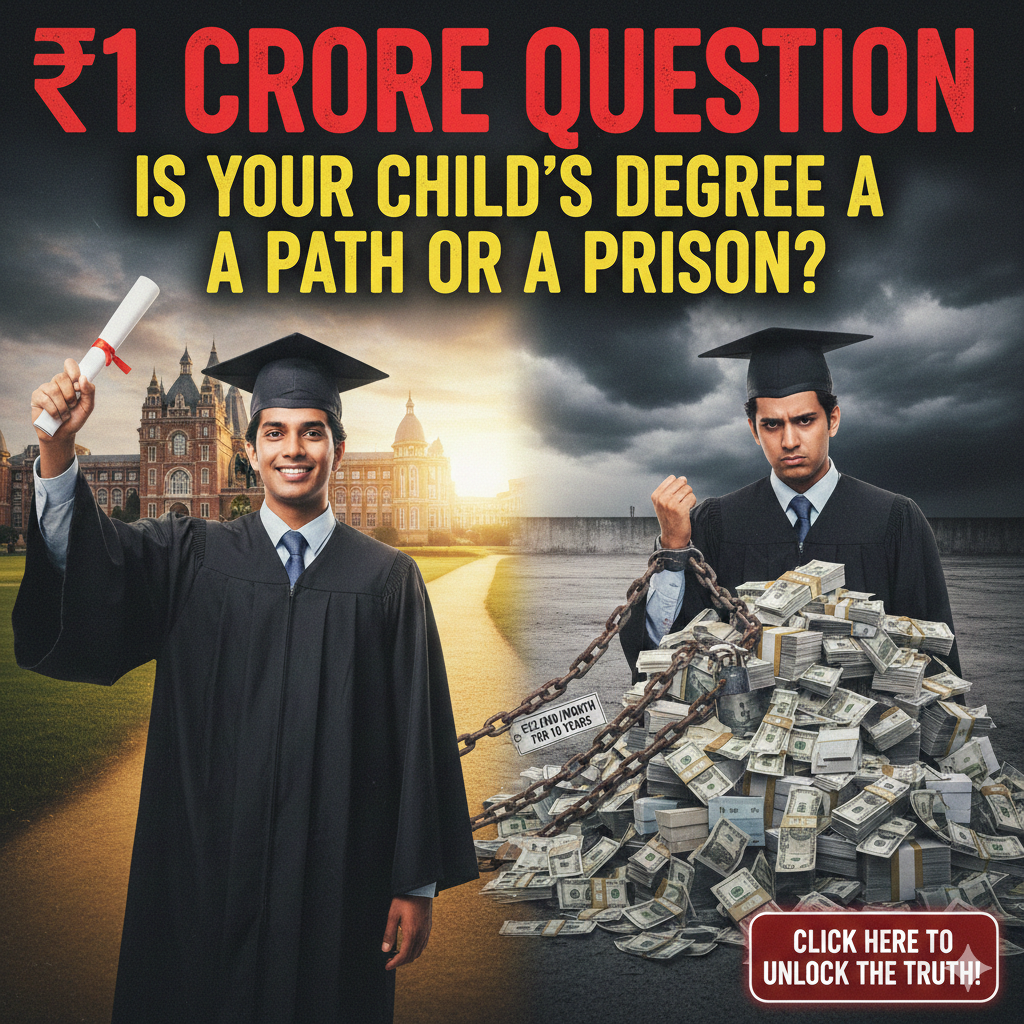

One solid idea comes into view when thinking about money worries among Indian families. Though many talk about expensive schooling, few look closely at what happens after securing a professional course seat. What feels like a smart move today might turn into long-term debt pressure tomorrow. Getting into medical school or business programs often means signing loans without seeing the full picture. The weight of repayment can stretch years, affecting choices far beyond graduation. Not every degree leads to earnings that cover its own cost. Some paths promise prestige yet deliver stress instead of stability. This gap between expectation and reality needs more attention. A closer look reveals how dreams get morphed with financial strain. Pressure to succeed mixes with mounting bills in ways people rarely discuss upfront.

Exactly right – zeroing in on targeted paths such as an MBA or medical training cuts through vague anxiety. Instead, it opens space for real data: costs versus earnings, payback periods, future income streams. Such a lens shifts attention toward actual planning, not guesswork. Readers weighing big money commitments gain something solid here. Decisions rooted in clarity tend to stick. Few things matter more when student debt looms large.

Read Also : https://karnatakaland.in/is-your-bank-account-shrinking-the-hidden-inflation-tax-in-india-2026/

Pride swells when your child earns admission to a prestigious university – then comes the bill. That moment shifts everything. Costs appear far beyond earlier expenses, dwarfing what families have already sacrificed. Not long ago, school fees stretched budgets thin; now, higher education demands even more. What once seemed like heavy spending now looks modest. Shock sets in upon seeing tuition numbers rise faster than wages. Many parents feel caught between celebration and dread. This new stage isn’t just costly – it reshapes life plans. Savings vanish quickly under institutional pricing models built on rising rates. Hope remains, though overshadowed by uncertainty about payment timelines. Each envelope received brings both accomplishment and stress. Future goals bend around financial obligations no one fully anticipated.

What occurs when families can no longer set money aside? One certified accountant observed a change: education costs now drive savings, not future hopes. Attention turns here – to the moment saving ends and debt takes its place. A diploma once promised security; now it demands careful thought like any bold purchase. Success isn’t automatic – more like a gamble weighed over months of planning. Value shifts yearly, shaped by costs, jobs, and timing. Choosing one feels less like tradition, more like strategy built on risk and numbers. Outcomes hinge not just on effort, but on cold calculations made long before graduation.

The Cost of a Dream Today

The MBA Maze: From IIFT to Private Colleges

- The Range: Detail the massive fee spectrum.

- Fees at elite schools like top IIMs typically fall between ₹15 and 25 lakh for the entire course. For global applicants, certain colleges set yearly charges above $11,000.

- Private colleges known for quality charge between ₹8 lakh and ₹12 lakh. Though costs differ, most fall within this span. Because of their standing, fees stay on the higher side. These institutions often justify pricing through facilities offered. While not regulated like public ones, they attract many applicants yearly.

- Private colleges typically charge between ₹3 and 8 lakh on average.

- Living in big cities adds up quickly, on top of tuition fees. Study supplies pile on extra charges each semester. Some programs include travel abroad, which means more spending. These expenses often surprise students who only budget for classroom instruction.

Read Also : https://karnatakaland.in/inflation-calculator-full-guide-how-to-use/

The Long and Winding Road of Medical Education

Facing higher expenses, many undergraduates find that a complete MBBS program, particularly in private institutions, may demand anything between ₹50 lakhs and more than ₹1 crore. Although education remains essential, financial pressure builds quickly when tuition climbs without matching support.

After graduation, many find that an MBBS by itself brings modest earnings. Instead of pursuing MD or MS – where costs can match earlier tuition – a growing number are turning to hospital management studies. These programs charge between ₹1.5 and 12 lakh, opening doors beyond patient care. Healthcare-focused MBA paths lead into administrative roles, fitting well within India’s expanding medical infrastructure. For some, stepping back from clinics makes long-term sense.

Why It Matter

Starting fresh with an MBA, pay often lands between ₹3.5 and 6 LPA. Graduates from elite schools such as AIIMS Delhi or IIMs may earn ₹20–30 LPA later on. Senior positions sometimes go even higher. Meanwhile, healthcare management expands fast. India’s health sector now totals $372 billion in value.

A single expert in medicine – say, a heart specialist or someone who operates – can reach top earnings within India or across borders; such roles often bring lasting stability alongside wide recognition from society. Besides strong job prospects, each area opens paths across many industries.

Everywhere demands MBA graduates – hospitals, tech startups, alike. While some enter healthcare, others build new firms from nothing. Where leadership gaps appear, they tend to follow. Though not always obvious, their role shapes how organizations move forward. Because systems grow complex, their training becomes useful across fields.

Starting off in clinics, medical graduates might later shift toward research roles. Public health opens paths through groups such as the WHO or various non-profits. Insurance sectors also offer opportunities after completing medical training. Some enter patient care right away, while others explore data-driven environments. Moving between fields is common, depending on interest shifts over time.

Work that matters goes further than paychecks – shaping companies or supporting patients shows how purpose drives effort. Though different paths, each opens doors to influence outcomes people feel deeply. One builds organizations step by step; the other eases suffering face to face. Value emerges not from titles, but from what changes because someone showed up.

The Downsides and Unseen Risks

Paying back loans often shapes career choices more than ambition does. For someone borrowing ₹20 lakh for an MBA at a 10% rate, monthly payments might exceed ₹22,000 across ten years. That kind of pressure turns high-paying roles into a necessity – passion takes a back seat when bills arrive. Graduates find themselves locked in jobs not by desire but by repayment timelines. Financial commitments quietly override personal goals. Long-term obligations begin right after degree completion. Salary becomes the deciding factor, even if it feels far from fulfilling.

What hides behind grand wedding celebrations? A quiet struggle unfolds when families face rising marriage expenses – typically reaching 35 to 40 lakh rupees. This growing burden pulls resources away from another priority: higher education. Instead of assuming both are manageable, many parents find themselves weighing one against the other. One goal advances while the other stalls. Rarely does anyone speak about this tension in public.

Once classes begin, interest starts adding up on education loans – a detail often missed by families. Though payments pause during study periods, the cost climbs behind the scenes. For example, a ₹20 lakh debt might grow to between ₹23 and ₹24 lakhs before repayments even start. This increase happens quietly, yet it shapes the total burden later.

Despite holding an MBA, those who graduate from less prestigious institutions often face shaky prospects in employment. Not every degree leads straight into well-paid roles – competition stands high across sectors. Many leave campus without offers matching what they invested upfront. What you get can depend heavily on chance, much like earlier stages of learning did. Uneven standards follow students beyond secondary classrooms, lingering through university years.

Years pass before physicians see steady income. Early careers bring modest paychecks during training phases. Repayment schedules begin long before salaries rise. Specialization demands stretch timelines further. Rewards arrive slowly, delayed by education costs. Financial relief often waits ten full years.

Read Also : https://karnatakaland.in/is-%e2%82%b91-crore-enough-to-retire-in-2045-the-hidden-impact-of-inflation/

Pros and Cons

| MBA From Top Schools | Versus | Medical Degree With Specialization |

| Pros | Pros | |

| One benefit stands out: a strong starting income. Fields across industries open up quickly after training ends. Reaching the workplace takes less time compared to other paths. Healthcare administration needs more workers every year. | Big earnings build steadily over years in another route. Respect follows certain careers wherever they go. Stability marks these roles even during economic shifts. Working abroad becomes a real possibility later on. Deep mental engagement keeps some professions exciting decade after decade. | |

| Cons | Cons | |

| Average colleges face stiff competition, yet many still enroll large numbers despite questionable returns on investment unless they rank among the elite; graduates often enter demanding corporate jobs. | Becoming a doctor takes years, tuition adds up quickly – especially in private institutions – which postpones earning potential while increasing emotional and physical strain over time. |

Frequently Asked Questions

1. Should I drain my retirement savings to pay for my child’s MBA?

Retirement savings? Experts say leave them alone. Opting for a student loan makes more sense – future earnings help cover that cost later. Once retirement funds dip, catching up feels nearly impossible. The money set aside now carries weight years down the line.

2. How does the return on investment compare between a medical degree and an MBA?

A degree from a leading business school tends to pay off sooner, bringing quicker financial returns. In contrast, medical training takes longer before earnings begin to match the investment. While doctors may eventually earn more, their income growth starts much later. For physicians, reaching that balance between cost and payoff typically happens well into their careers.

3. How does wedding inflation affect education savings?

Now more than ever, wedding expenses – often surpassing ₹35 lakh – are reshaping financial priorities. Instead of pooling money into one reserve, households commonly divert funds meant for schooling toward marriage plans. Well ahead of major life events, say 7 to 10 years prior, carving out distinct pools helps prevent trade-offs. One pot grows quietly for university fees; another builds steadily for ceremonies. Spreading resources this way reduces strain when both goals demand attention at once.

4. Is an MBA in Hospital Management a Good Compromise?

True, if medicine isn’t the goal yet health remains a priority. This path leads into India’s expanding healthcare sector – valued at $372 billion – with tuition between ₹1.5 and 12 lakhs. Earnings later range from ₹4 to 15 lakh per year.

5. Is it possible to protect this investment?

A promise of return on investment stays uncertain, yet protection for specific outcomes remains possible. Much like coverage exists today if a wedding gets called off, similar safeguards apply elsewhere. When it comes to education loans, think beyond repayment plans. Protection kicks in when hardship strikes – say, health issues or job loss affecting the family earner or the learner themselves. Unplanned events unfold without warning; having backup shifts how consequences play out. Risk doesn’t disappear, though its impact may lessen with foresight built in.

Conclusion

A closer look reveals one way to organize this article, shaped by recent findings and patterns to build something clear and useful. What follows takes form through up-to-date insights, guiding each section with real shifts in the topic. Structure emerges not from rules but from what current evidence suggests matters most. Each part connects – sometimes subtly – to maintain flow without forcing links. This approach grows out of observation rather than preset design, letting logic shape the path. Details fit together because they reflect how things actually stand now, not how they once were.

Here’s what stands clear: pursuing a professional degree acts like an investment built on borrowed support. Success hinges on reducing that borrowing while strengthening the outcome – what it opens up professionally. What matters grows not from cost alone, but how much value emerges later. A fresh perspective begins here: choosing a degree needs budgeting awareness. Families ought to examine course details much like investment disclosures. Hard queries matter – ones targeting job outcomes, typical salaries, pay growth over time, rather than focusing on buildings or amenities alone.

A different way to see it: the aim is making sure the diploma opens doors instead of chaining someone to payments for years. This isn’t chasing dreams at any cost – it’s building what comes next without drowning in numbers. What matters grows when education lifts lives, not balances on a ledger. This framework builds from your details – growing tuition rates, exact MBA expenses, alongside burdens tied to milestones such as marriage ceremonies – to shape a full picture, delivered at just the right moment.

I am Yallappa Bichagatti and i’m seasoned financial professional with over 13 years of extensive experience in the banking and finance sector. Throughout his career, he has held key positions in Retail Banking, Wealth Management, and Corporate Finance, where he specialized in tax optimization, investment strategies, and large-scale portfolio management. Driven by a mission to bridge the gap between complex financial regulations and the common man, he founded karnatakaland.in to provide simplified, data-driven utility tools